Interested? Contact us now

In order to contact us please fill the form on the right or directly email us at the address below

sales@senecaesg.com

The Tokyo Metropolitan Government (TMG) is preparing to issue the world’s first-ever certified climate-resilience bond, the TOKYO Resilience Bond, marking a significant milestone in sustainable finance. The bond has achieved certification under the newly launched Resilience Criteria and Taxonomy of the Climate Bonds Initiative (CBI), expanding the scope of climate-bond credentials beyond traditional mitigation toward adaptation and resilience.

With a target issuance of around JPY 50 billion (approx. USD 330 million), the proceeds will be dedicated exclusively to the TOKYO Resilience Project: a comprehensive program designed to strengthen Tokyo’s infrastructure and urban systems against climate-driven disasters like floods, storm surges, typhoons and seismic risk. The eligible projects include flood-control work on small and medium rivers, upgraded coastal-protection infrastructure around Tokyo Bay and remote islands, undergrounding utility poles to reduce disaster risk, and port facility renovations on vulnerable island communities.

According to TMG, the bond framework is designed to attract both domestic and international capital, leveraging the external certification and robust governance structure to give investors’ confidence in its climate-resilience credentials. The introduction of the CBI’s Resilience Taxonomy means that adaptation-oriented investments, once a niche, now have a globally recognized standard, potentially unlocking institutional capital for resilience infrastructure.

For investors and the broader market, Tokyo’s move signals a new chapter: issuing debt where the use of proceeds is tied not to emissions reduction, but to bolstering urban resilience and protecting people, infrastructure and ecosystems from climate risks. By becoming the first city to adopt this model, Tokyo is positioning itself as a leader in the emerging field of resilience finance and may serve as a template for cities worldwide.

In short, the TOKYO Resilience Bond represents more than just a new financial instrument: it marks the evolution of sustainable finance from mitigation to full-spectrum climate action. As climate-change impacts intensify globally, this issuance could catalyze a shift toward resilience-linked capital flows and a broader definition of what ‘green’ or ‘sustainable’ finance can entail.

Source:

https://esgnews.com/tokyo-to-issue-worlds-first-certified-climate-resilience-bond/

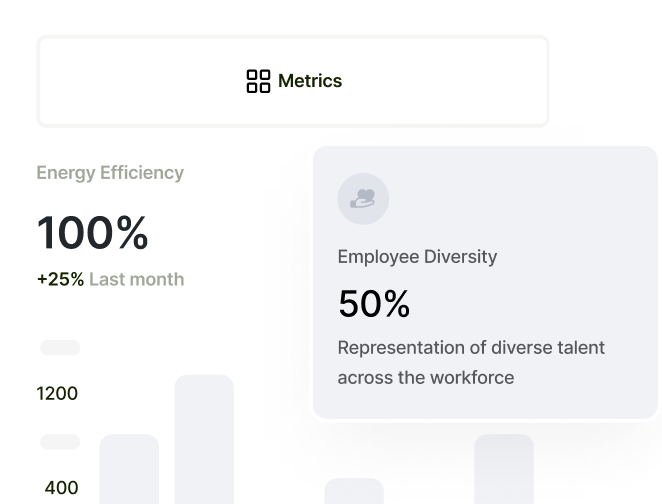

Monitor ESG performance in portfolios, create your own ESG frameworks, and make better informed business decisions.

In order to contact us please fill the form on the right or directly email us at the address below

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapore 018936

+(65) 6223 8888

Gustav Mahlerplein 2 Amsterdam, Netherlands 1082 MA

(+31) 6 4817 3634

77 Dunhua South Road, 7F Section 2, Da'an District Taipei City, Taiwan 106414

(+886) 02 2706 2108

Viet Tower 1, Thai Ha, Dong Da Hanoi, Vietnam 100000

(+84) 936 075 490

Av. Santo Toribio 143,

San Isidro, Lima, Peru, 15073

(+51) 951 722 377

1-4-20 Nishikicho, Tachikawa City, Tokyo 190-0022